work opportunity tax credit questionnaire form

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Below you will find the steps to complete the WOTC both ways.

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Questions and answers about the Work Opportunity Tax Credit program.

. Complete WOTC survey process. There are two sets of frequently asked questions for WOTC customers. WOTC Improve Your Chances of Being Hired The Work Opportunity Tax Credit WOTC can help you get a job.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Are employees required to fill out WOTC form. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Credit Application Form Check More At Https Nationalgriefawarenessday Com 1508 Credit Application Form Application Form Application Credit Card Application What is the Work Opportunity Tax Credit Questionnaire.

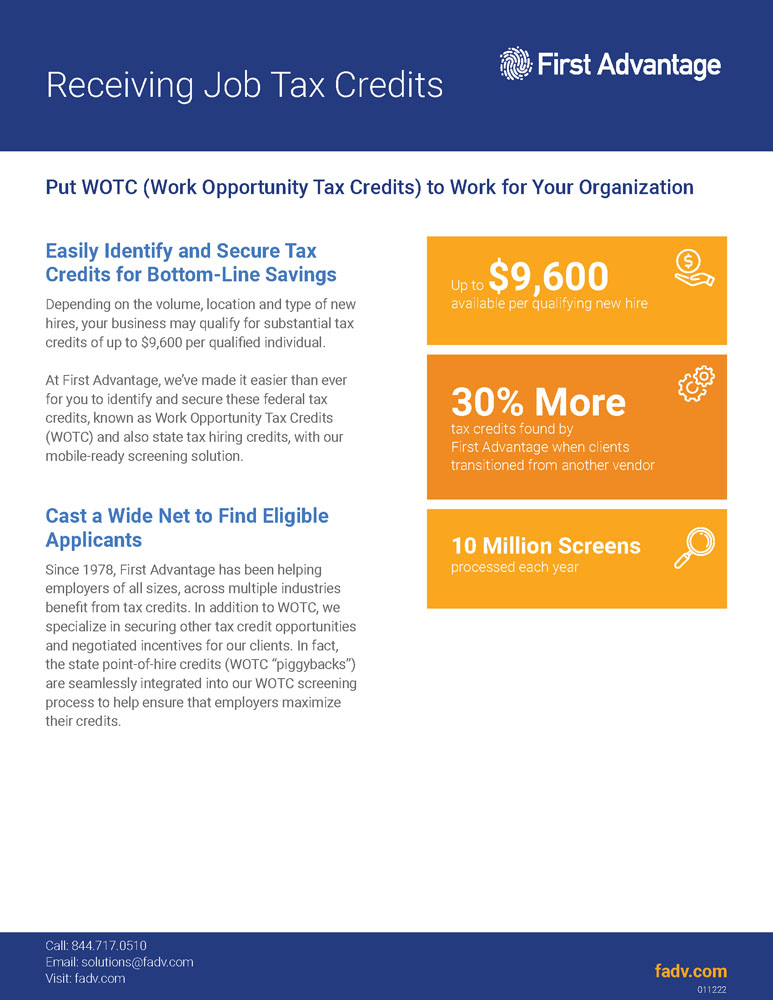

If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. 1 Legal Form library PDF editor e-sign platform form builder solution in a single app. The form may be completed on behalf of the applicant by.

The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The answers are not supposed to give preference to applicants.

Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. This program is designed by the federal government to help companies hire more people into the workforce and to retain employees through federal incentives. Below you will find the steps to complete the WOTC both ways.

WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

Employers must apply for and receive a certification verifying the new hire is a. The information will be used by the employer to complete the employers federal tax return. Complete only this side.

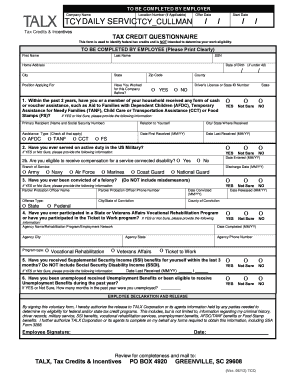

Page number one of Form 8850 contains the questionnaire of the Work Opportunity Tax Credit. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. If so you will need to complete the questionnaire when you apply to a position or. Employers use Form 8850 to pre-screen and to make a written request to their state workforce agency SWA to certify an individual as a member of a targeted group for purposes of qualifying for the work opportunity credit.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been on food stamps ex. Completion of this form is voluntary and may assist members of targeted groups in.

WOTC Target Groups include. It contains questions related to their previous life such as if they have worked in any military service their participation in any government assistance programs recent unemployment and other targeted questions. Completing Your WOTC Questionnaire.

Employers use Form 8850 to make a written request to their SWA to certify someone for the work opportunity credit. Is participating in the WOTC program offered by the government. Your name Social security number a.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Work Opportunity Tax Credit questionnaire. Completing Your WOTC Questionnaire.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Page one of Form 8850 is the WOTC questionnaire.

Fill in the lines below and check any boxes that apply. January 2012 Department of the Treasury Internal Revenue Service Pre-Screening Notice and Certification Request for the Work Opportunity Credit a See separate instructions. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Work Opportunity Tax Credit WOTC Frequently Asked Questions. This tax credit may give the employer the incentive to hire you for the job.

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. And administered by the Internal Revenue Service. Internal Revenue Code Section 51 d 13 permits a prospective employer to request the applicant to complete WOTC Form 8850 and give it to the prospective employer.

Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program. 1Long-Term Unemployment Recipient Self-Attestation Form 2Tax Credit Questionnaire TALX form 3Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit Please complete all the forms by printing all responses. There are 3 forms that need to be reviewed and completed.

1 the employer or employer representative the SWA a participating agency or 2 the applicant directly if a minor the parent or guardian must signtheform andsignedBox 25aby theindividual completingthe.

Esg Diligence Questionnaire Borrower Lsta

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Retrotax Bamboohr Marketplace Your Favorite Integrated Hr Apps

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit First Advantage

Completing Your Wotc Questionnaire

Get And Sign Wotc Questionnaire 2012 2022 Form

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller